When a property suffers hail damage, the owner may have difficulty determining the amount of damage and the value of the loss. The owner may lack experience in damage assessment or negotiating with the insurance company to receive fair compensation. This is where a public adjuster comes in.

A public adjuster is a professional who works on behalf of the owner to evaluate damages, file an insurance claim, and negotiate with the insurance company to obtain maximum compensation possible. The public adjuster has a deep understanding of the insurance claims process and can help the owner avoid common mistakes that could reduce the value of their claim.

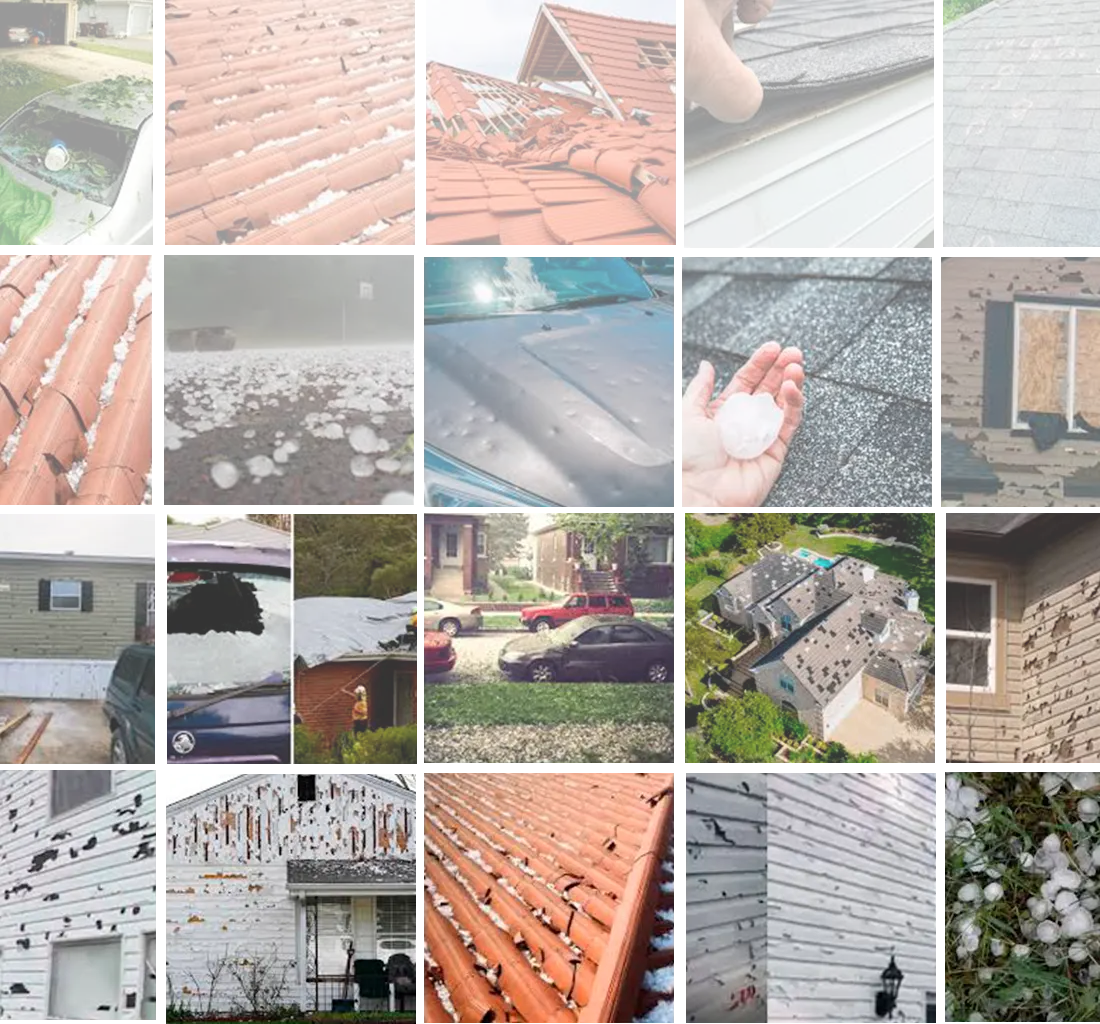

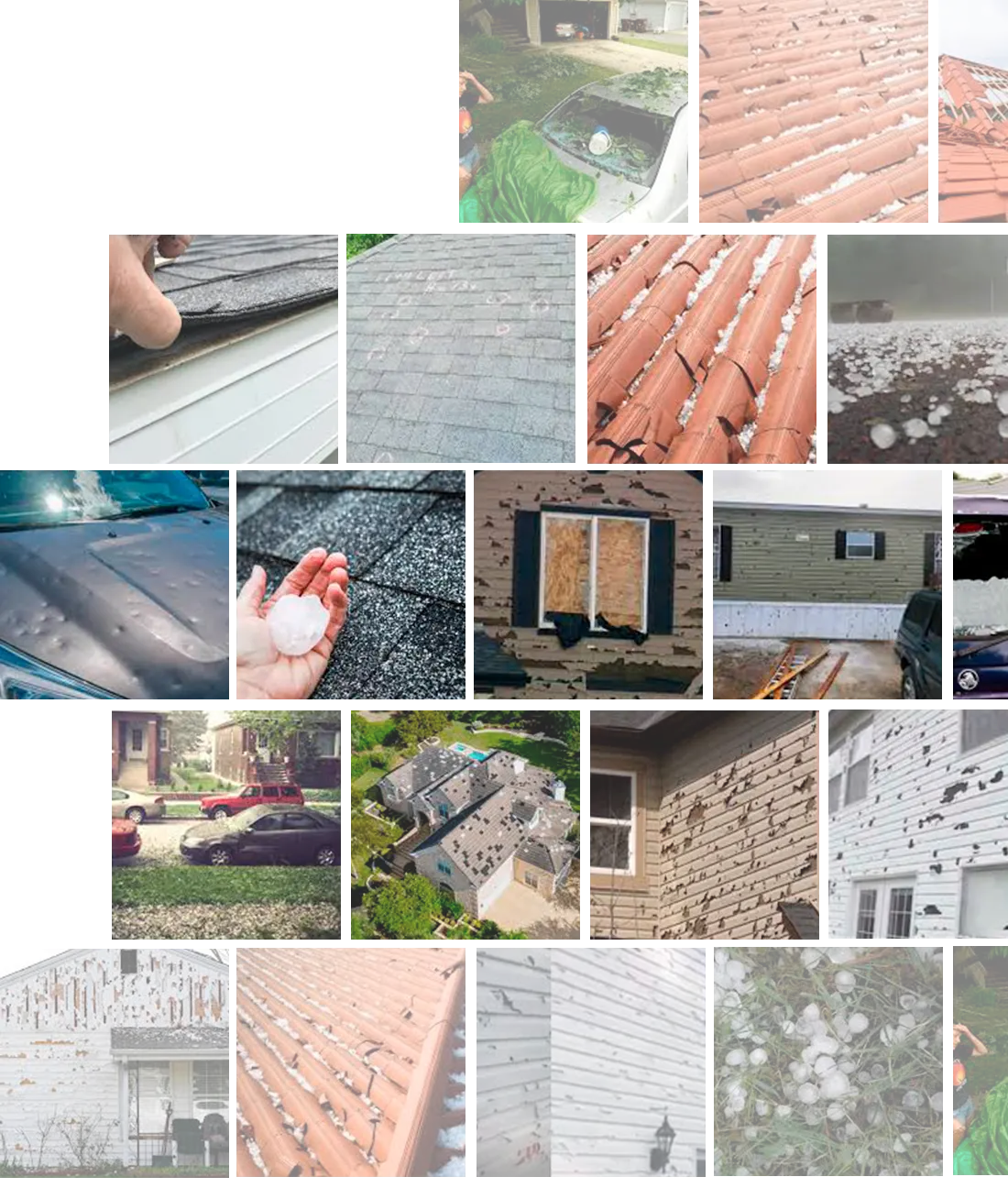

Hail damage can be difficult to detect, especially on high-elevation roofs and siding. Additionally, some damages may not be visible to the untrained eye. A public adjuster can identify even the smallest damages and ensure the owner receives full compensation for the damages.

In summary, hail damage can have a significant impact on the property and the owner’s life. A public adjuster can be the key to receiving fair and complete compensation for damages. If your property has suffered hail damage, do not hesitate to contact a public adjuster for professional advice and assistance.